India’s startup ecosystem is thriving, from fintech innovators in Mumbai to tech trailblazers in Bengaluru. At the heart of every successful venture lies business law in India—the strategic framework that protects your ideas, ensures compliance, and fuels growth.

Whether you’re an entrepreneur launching a fintech startup, a student dreaming of a tech empire, or a business owner scaling up, mastering business law in India is your edge in this dynamic market.

At Finlawpro.com, we empower startups, entrepreneurs, and students in finance, business, and technology with legal insights. This ultimate 2025 guide explores the five pillars of business law in India, packed with practical tips and Indian examples to help you succeed.

Why Business Law in India is Your Startup’s Superpower

Business law in India governs how you start, run, and grow your venture, covering laws like:

- Indian Contract Act, 1872

- Companies Act, 2013

- GST Act, 2017

- Trademarks Act, 1999

For fintech startups, it safeguards payment systems; for tech entrepreneurs, it protects apps; and for students, it’s the foundation for turning ideas into reality.

A 2024 NASSCOM report found that 35% of Indian startups fail due to legal oversights. Don’t let that be you—leverage business law in India to build a legally sound business.

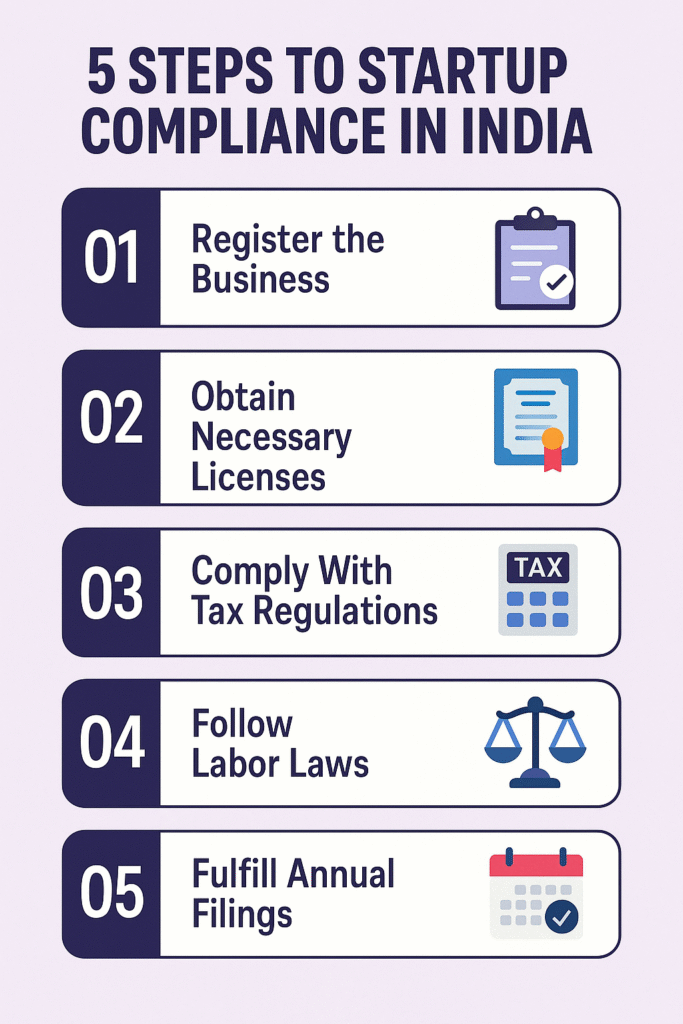

The Five Pillars of Business Law in India

1. Choosing the Right Business Structure: Your Launchpad

Your business structure shapes taxes, liability, and investor appeal. Business law in India offers options for every ambition:

- Sole Proprietorship: Ideal for students starting a side hustle, like a financial blog. It’s simple but risks personal assets if debts arise.

- Partnership Firm: Governed by the Indian Partnership Act, 1932, it suits group ventures. A clear partnership deed prevents disputes, like a 2023 Kolkata firm’s ₹6 lakh legal battle over profit splits.

- One Person Company (OPC): Under the Companies Act, 2013, an OPC offers limited liability for solo founders, perfect for a student’s tech venture.

- Private Limited Company: The top choice for startups, offering credibility and funding potential. Ola’s private limited status helped it raise ₹2,000 crore in 2022.

- Limited Liability Partnership (LLP): Balances flexibility and protection, great for fintech consultancies.

Pro Tip: For finance and tech startups, a Private Limited Company aligns with business law in India, signaling trust to investors via Startup India. Students can start with a Sole Proprietorship for low-risk projects. Register on the MCA portal and consult a chartered accountant.

2. Crafting Watertight Contracts: Your Trust-Building Tool

Contracts, under the Indian Contract Act, 1872, are the backbone of business deals. Whether you’re a fintech startup signing with investors or a student freelancing tech services, business law in India ensures contracts prevent chaos.

Tips for solid contracts:

- Be Clear: Define deliverables, payments, and timelines. A tech contract might specify app development milestones and a 3% late-delivery penalty.

- Plan for Disputes: Include arbitration clauses per the Arbitration and Conciliation Act, 1996, to avoid slow courts.

- Ensure Validity: Contracts need mutual consent and lawful purpose. A lawyer’s review catches gaps.

- Go Digital: Use e-signatures via Signzy, compliant with the Information Technology Act, 2000.

Case: In 2024, a Hyderabad startup lost ₹12 lakh due to a vague vendor contract. Clear contracts, guided by business law in India, save money and build trust.

3. Protecting Intellectual Property: Your Innovation Shield

In finance and tech, your ideas—apps, algorithms, or logos—are your edge. Business law in India protects them:

- Trademarks: Register your brand under the Trademarks Act, 1999 via IP India. Zerodha’s trademarked logo sets it apart.

- Copyrights: Secure content like financial blogs or code under the Copyright Act, 1957. Students can copyright pitch decks.

- Patents: Protect tech innovations, like a payment gateway, under the Patents Act, 1970. A Pune startup’s patented AI tool gave it a 20-year lead.

- Trade Secrets: Use NDAs for sensitive data, like a fintech’s analytics.

Case: A 2024 Delhi startup lost ₹10 lakh when a competitor copied its untrademarked app design. Trademark registration (₹5,000–₹20,000) is a small cost for protection under business law in India.

4. Navigating Compliance: Your Key to Credibility

India’s regulatory landscape is complex but critical. Business law in India mandates:

- Licenses: Secure permits like the Shop and Establishment Act license or RBI licenses for fintechs (e.g., NBFCs).

- GST Compliance: Register for GST under the GST Act, 2017 if turnover exceeds ₹20 lakh (₹10 lakh in special states). A 2024 Mumbai startup paid ₹4 lakh in GST penalties.

- Data Protection: The Digital Personal Data Protection Act, 2023 (DPDP Act) mandates secure data handling, crucial for fintechs. Fines can hit ₹250 crore.

- Industry Rules: Fintechs follow RBI KYC norms; tech firms comply with IT Rules, 2021.

Stat: A 2024 FICCI survey found 75% of investors favor compliant startups. Use ClearTax for GST or Zoho Books for compliance.

5. Employment Law: Hiring for Growth

Hiring triggers business law in India labor regulations:

- Contracts: Define roles and pay under the Indian Contract Act, 1872. Clarify contractor status.

- Labor Laws: Follow the Minimum Wages Act, 1948, EPF for 20+ employees, and Payment of Bonus Act, 1965. A 2024 Bengaluru startup paid ₹5 lakh for skipping EPF.

- Workplace Fairness: Comply with the Sexual Harassment of Women at Workplace Act, 2013, requiring an ICC for 10+ employees.

- Gig Economy: Clear freelancer contracts prevent disputes, as seen in a 2023 Pune case costing ₹3 lakh.

Takeaway: Strong hiring practices attract talent and keep your startup legal.

Your 2025 Action Plan

- Consult Experts: Use Vakilsearch or IndiaFilings for legal guidance.

- Register Smart: File for a Private Limited Company or LLP on MCA.gov.in; apply for GST on GST.gov.in.

- Protect IP: Register trademarks and copyrights via IPIndia.nic.in.

- Simplify Compliance: Use ClearTax for GST, Zoho Payroll for EPF.

- Stay Updated: Follow Finlaw Pro for updates on MCA, RBI, and Startup India.

Case Study: A Costly Lesson

In 2024, a Noida fintech startup lost ₹18 lakh when a competitor copied its unpatented payment system and faced RBI penalties for KYC non-compliance.

Business law in India could have saved them with early IP protection and compliance.

Why It Matters

Business law in India empowers your startup to:

- Protect Assets: A Private Limited Company shields personal wealth.

- Attract Funding: Compliance impresses investors like Shark Tank India.

- Build Trust: Legal clarity wins customers in fintech and tech.

- Enable Growth: Supports expansion via Startup India.

Take the Next Step with Finlawpro.com

Ready to launch a legally sound startup?

At Finlawpro.com, we provide expert insights on finance, business, technology, and legal strategies for entrepreneurs and students.

👉 Subscribe to our newsletter for 2025 updates, or contact us for personalized legal guidance!